Remember when you could run your Amazon business with just one sharp account manager who handled everything? Those days are gone.

By 2026, Amazon has evolved into something entirely different: a hyper-competitive ecosystem that changes rules faster than most teams can adapt. What worked in 2021 is now a recipe for stagnation (or worse, account suspensions).

If you're wondering whether your in-house team can keep up with the demands of modern Amazon selling, you're asking the right question. Here are seven unmistakable signs you've outgrown your current setup: and what to do about it.

Sign #1: Your PPC Performance Has Plateaued (Or Is Declining)

Your advertising cost of sales (ACoS) keeps creeping up, but sales stay flat. You've tried "optimizing" campaigns, but nothing seems to move the needle anymore.

**Here's the thing: ** Amazon advertising in 2026 requires specialized expertise. We're talking about:

- AI-driven bid adjustments based on conversion probability

- Multi-dimensional audience targeting

- Strategic dayparting and geographic optimization

- Cross-ASIN campaign coordination

- Real-time competitive response strategies

Most in-house teams have one person handling PPC along with ten other responsibilities. They're running campaigns based on 2022 best practices while your competitors are leveraging 2026 technology.

What this costs you: Every percentage point of unnecessary ACoS on a $500K annual ad spend equals $5,000 in wasted budget. Scale that across multiple products and you're looking at serious money left on the table.

If your team is still manually adjusting bids weekly instead of using sophisticated automation tools, you've outgrown their capacity. Professional amazon ads management teams now use AI-powered platforms that make micro-adjustments hundreds of times per day.

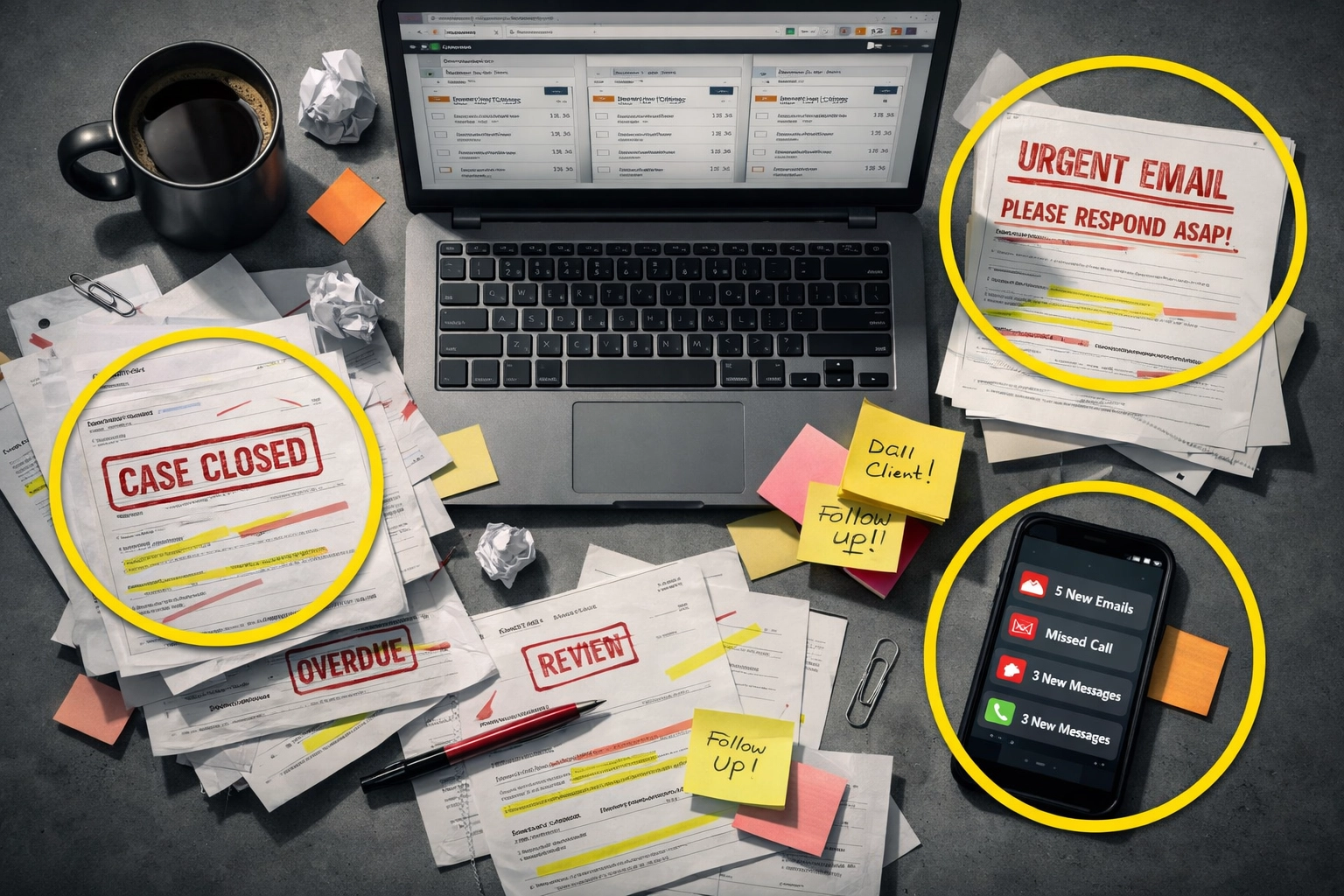

Sign #2: Account Health Issues Keep Blindsiding You

You get hit with a policy violation notice. Nobody on your team saw it coming. Suddenly, you're scrambling to file appeals while your listing is suppressed and revenue flatlines.

The problem? Account health monitoring in 2026 requires constant vigilance across dozens of metrics:

- Policy compliance changes (Amazon updates these weekly)

- Intellectual property complaints

- Product authenticity concerns

- Customer service performance metrics

- Order defect rates and late shipment tracking

- Inventory performance index (IPI) management

Your in-house team is reactive instead of proactive. They're fighting fires instead of preventing them.

What professional teams do differently: Dedicated account health specialists monitor your account 24/7, catch issues before they escalate, and have established relationships with Amazon seller support for faster escalation resolution when needed. They know which issues require immediate action and which can wait.

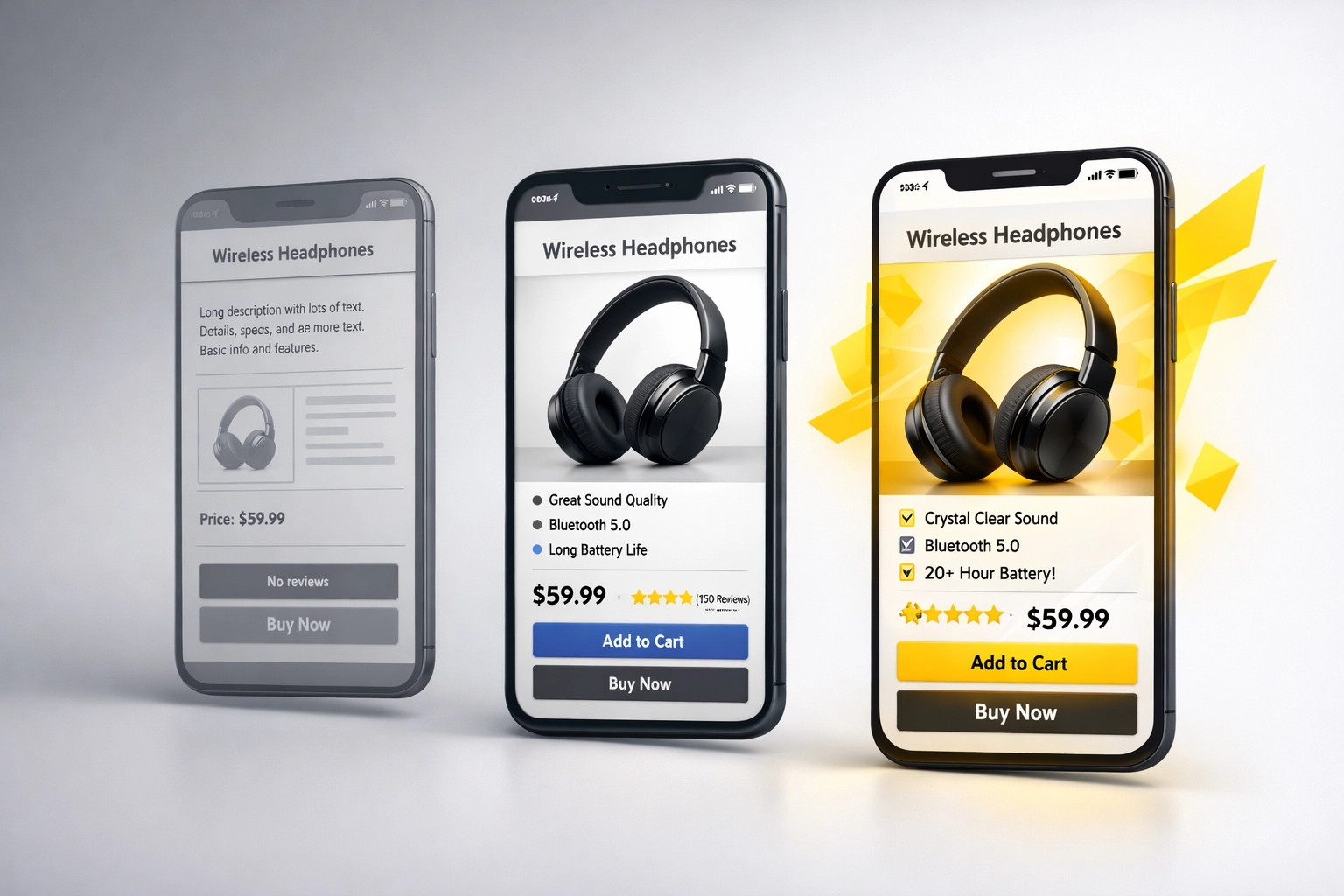

Sign #3: You're Losing the Listing Optimization Battle

Your product titles, bullet points, and A+ Content were great when you launched. Two years later? They're outdated, keyword-stuffed, and definitely not optimized for Amazon's Rufus AI shopping assistant.

Here's what's changed: Listing optimization in 2026 isn't just about cramming keywords into your title anymore. It's about:

- Natural language that resonates with AI search algorithms

- Strategic keyword placement that balances human readability with algorithmic preferences

- Backend search term optimization that changes quarterly

- A+ Content that actually converts (not just looks pretty)

- Mobile-first formatting that accounts for how 70%+ of shoppers actually browse

Your in-house team updated your listings once. Maybe twice. Professional amazon listing optimization teams treat this as an ongoing process, testing and refining monthly based on performance data.

The gap widens: While you're sitting on static content, competitors with specialized teams are A/B testing headlines, rotating seasonal imagery, and updating backend keywords based on trend analysis.

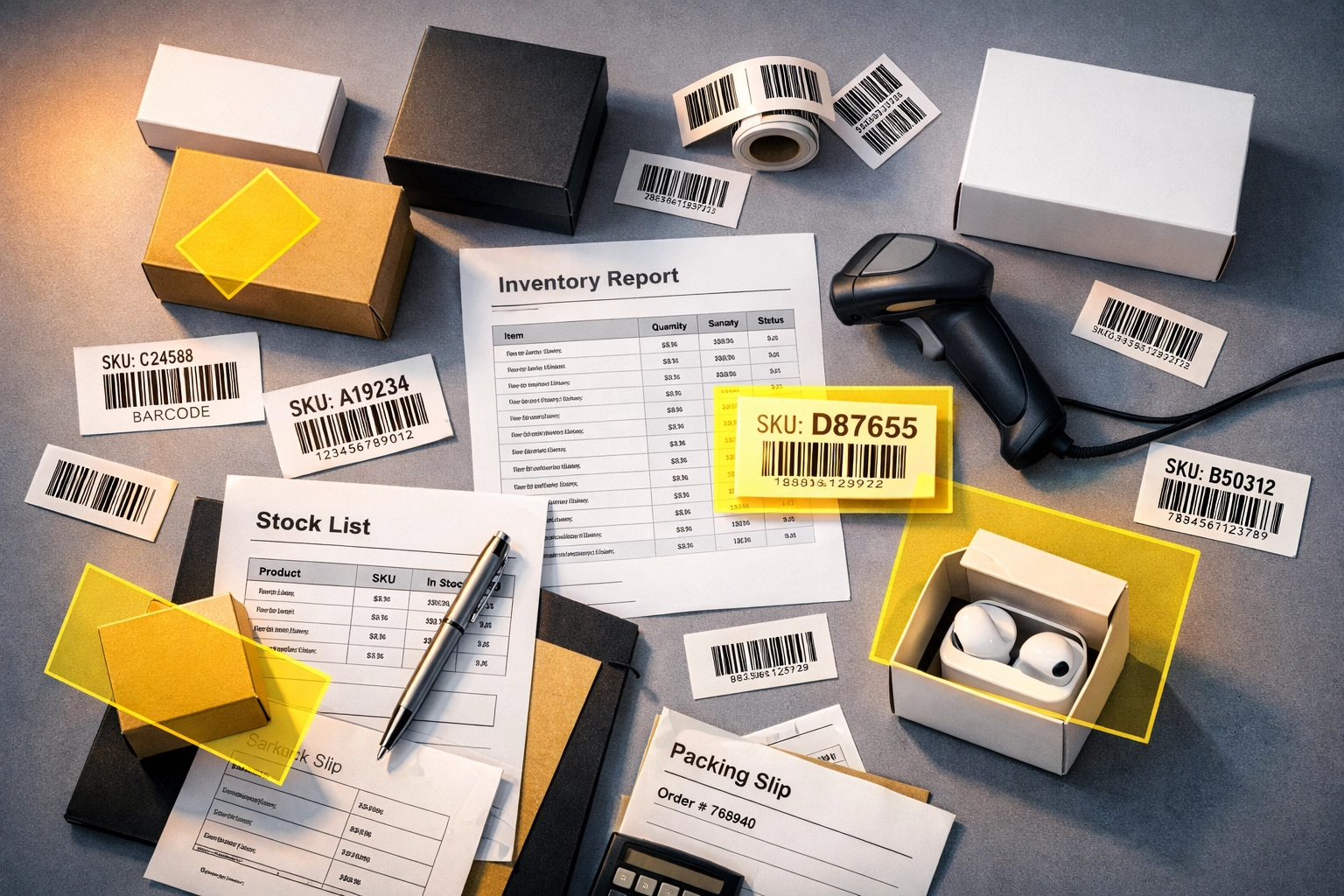

Sign #4: Catalog Management Has Become a Nightmare

You've got variation errors. Parent-child relationships that broke mysteriously. Listings that got merged with competitors' products. SKU mismatches between your system and Amazon's.

Reality check: Catalog management in 2026 requires technical expertise that most business owners don't have (and shouldn't need to have). You need people who understand:

- Flat file templates and bulk upload procedures

- Variation theme requirements for different categories

- Brand Registry nuances and GTIN exemptions

- Global catalog harmonization if you sell internationally

- API integrations between your inventory system and Amazon

When your in-house generalist is spending hours troubleshooting why a variation won't publish correctly, you're paying skilled labor rates for technical troubleshooting that specialized teams handle in minutes.

Sign #5: You're Missing Out on Money Amazon Owes You

Amazon makes mistakes. Lost inventory. Damaged goods in fulfillment centers. Fee errors. Overcharged storage fees.

The question is: Is anyone on your team systematically auditing for these errors and filing reimbursement claims?

Most in-house teams don't have the bandwidth for amazon reimbursement audits. It's tedious, time-consuming, and requires specialized knowledge of Amazon's reimbursement policies.

What you're leaving behind: The average seller is owed 1-3% of their revenue in unclaimed reimbursements. For a $2M seller, that's $20,000-$60,000 annually just sitting there. Professional agencies have dedicated teams and automated tools that catch these discrepancies and file claims on your behalf.

Sign #6: Strategic Planning Gets Pushed to "Next Quarter" Every Quarter

You know you should be:

- Expanding into new product categories

- Testing international marketplaces

- Developing a comprehensive brand strategy

- Building a proper product launch calendar

- Creating defensible moats around your best sellers

But your team is too busy putting out fires. Strategic planning keeps getting delayed because everyone's focused on day-to-day operations.

This is the clearest sign you've outgrown your team. When you're stuck in reactive mode, you can't scale. Growth requires strategic thinking, market analysis, and coordinated execution across multiple channels.

Professional amazon brand management teams bring strategic planning expertise. They're looking six months ahead while managing today's operations. They know when to launch new products, how to coordinate promotions across your catalog, and how to build sustainable competitive advantages.

Sign #7: Your Team Can't Keep Up with Amazon's Changes

Amazon released new policies last week. Your team hasn't read them yet. New advertising features launched last month. Your team doesn't know they exist.

Here's what the research shows: In 2018-2021, one competent account manager could handle everything. In 2026? It's impossible. The platform has become too complex, too fast-moving, and too specialized.

A professional amazon agency now requires:

- Listing specialists who focus solely on content optimization

- PPC managers who live in advertising dashboards

- Design teams creating scroll-stopping creatives

- Account health experts monitoring compliance

- Backend optimization specialists handling catalog management

- Analytics teams turning data into actionable insights

Your single in-house manager (or even small team) is trying to compete against this level of specialization. It's not a fair fight.

What to Do Next: Your Options for Scaling

If you're seeing 3+ of these signs, it's time to seriously evaluate your amazon account management services strategy.

You have three paths forward:

Option 1: Hire More Specialists In-House

Pros: Direct control, full-time dedication to your brand

Cons: Expensive ($300K+ annually for a proper team), hard to recruit top talent, training takes months, high turnover risk

Option 2: Hybrid Model

Keep strategic oversight in-house but outsource specialized functions like PPC management, listing optimization, or account health monitoring to specialized partners.

Pros: Maintains control while accessing expertise, scalable based on needs

Cons: Requires coordination between multiple vendors, potential communication gaps

Option 3: Full-Service Amazon Agency

Partner with a comprehensive agency that handles everything from listing optimization to advertising to account health.

Pros: Complete specialization across all functions, proven processes, rapid scaling capability, cost-effective compared to building in-house

Cons: Less direct control over day-to-day decisions (though reporting should be transparent)

The Bottom Line

Amazon in 2026 isn't the platform you started selling on. The complexity has increased exponentially. The competition has gotten fiercer. The tools and strategies that drive success have become specialized.

Your in-house team might be incredibly talented: but if they're stretched thin across too many responsibilities, they can't deliver the focused expertise each area demands.

The data backs this up: Sellers working with professional agencies grew 30% year-over-year in 2025, massively outpacing Amazon's predicted 5-10% marketplace growth. That's not coincidence: it's specialization winning.

The question isn't whether you need help. It's whether you're ready to stop leaving money on the table while your competitors pull ahead.

If you're experiencing even a few of these signs, it's worth having a conversation about what professional amazon account management services could do for your business. The gap between generalist management and specialized expertise only widens from here.

What's your next move?

Struggling with scaling on Amazon? Want to talk through whether your team has the bandwidth for 2026's challenges? Let's chat about what a specialized approach could mean for your bottom line.

#AmazonSelling #EcommerceTips #AmazonFBA #AmazonAgency #AccountManagement #AmazonPPC #SellerTips