Selling on Amazon in 2026 isn't just about having a great product anymore. It’s about navigating a complex, ever-changing ecosystem that demands your attention 24/7. Between managing PPC bids, fighting off "buy box" hijackers, optimizing listings for the latest A9 algorithm update, and keeping your account health in the green, it’s easy to feel like you’re drowning in data.

If you’ve ever felt like you’re working for Amazon rather than using Amazon to work for you, you’re not alone. This is exactly where amazon account management services come into play. They are the secret weapon of high-growth brands that want to scale without the headache of daily micro-management.

In this guide, we’re going to pull back the curtain on how a professional amazon agency operates and how these services can transform your business from a "side hustle" into a dominant market force.

Here’s what we’ll cover:

- What "Full-Service" Amazon management actually means.

- The core pillars of success: Listings, Ads, and Logistics.

- How to handle the dreaded Seller Support through professional escalation.

- Protecting your profit with reimbursement audits.

- How to choose the right partner for your brand's journey.

Let’s dive in! 🚀

What Exactly are Amazon Account Management Services?

Think of an amazon agency as your dedicated "Mission Control." Instead of you trying to wear ten different hats: copywriter, graphic designer, logistics coordinator, and data scientist: you hire a team of specialists who live and breathe the platform.

Amazon account management services provide a comprehensive suite of tools and strategies designed to handle every aspect of your Seller Central or Vendor Central account. It’s not just about keeping the lights on; it’s about aggressive growth, brand protection, and operational efficiency.

Why You Can’t "Set It and Forget It"

The "Gold Rush" days of Amazon are over. Today, the marketplace is highly competitive and technically demanding. If your inventory levels dip, your rankings tank. If your ad spend isn't optimized, your margins vanish. Having a professional team ensures that every lever is being pulled at the right time.

Pillar 1: Amazon Listing Optimization 🎨

Your product listing is your digital storefront. If it’s messy, confusing, or poorly lit, people will walk right past it. Amazon listing optimization is more than just throwing a few keywords into a title; it’s about conversion rate optimization (CRO).

A professional agency focuses on:

- Keyword Strategy: Moving beyond basic terms to find high-intent long-tail keywords.

- Visual Storytelling: Using high-quality images and A+ Content to answer customer questions before they even ask them.

- Copywriting that Converts: Writing for both the Amazon algorithm and the human brain.

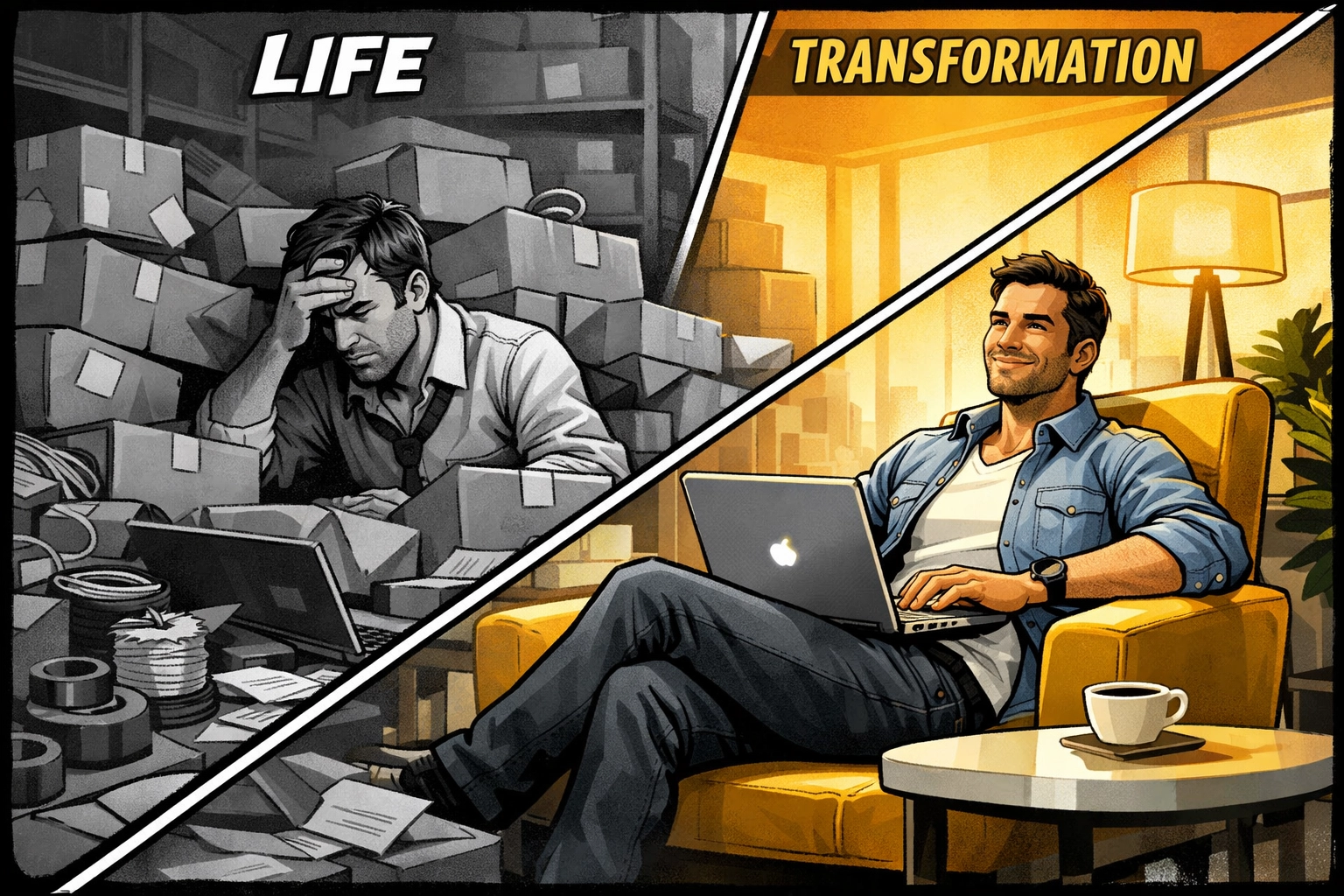

Visual: A comic-book style "Before and After" comparison showing a cluttered, boring listing transforming into a vibrant, high-converting masterpiece.

By focusing on listing optimization, you ensure that every dollar you spend on traffic actually has a chance of turning into a sale.

Pillar 2: Dominating the Auction with Amazon Ads Management 📈

Traffic is the lifeblood of Amazon, but not all traffic is created equal. This is where an amazon advertising agency earns its keep. Managing amazon ads management (PPC) is a full-time job. With fluctuating bid prices and new ad types appearing every month, you need a strategy that protects your ACOS (Advertising Cost of Sales) while maximizing your TACOS (Total Advertising Cost of Sales).

The Strategic Edge

A high-level amazon advertising agency doesn't just "set bids." They utilize:

- Sponsored Products, Brands, and Display: A multi-layered approach to catch shoppers at every stage of the funnel.

- Bidding Strategies: Knowing when to be aggressive and when to pull back. Check out these 4 bidding strategies that can make or break your Amazon ads to see the level of detail required.

- Regular Audits: If you haven't looked at your data lately, start with a 10-minute Amazon PPC audit to find the low-hanging fruit.

Pillar 3: Logistics and the Amazon FBA Prep Service 📦

Inventory is the most expensive part of your business. If you run out of stock, Amazon's algorithm penalizes you. If you have too much, you’re hit with long-term storage fees.

Managing this balance is part of professional amazon account management services. This often includes utilizing an amazon fba prep service. Why? Because Amazon is notoriously picky about how items are labeled and packaged. One mistake can lead to rejected shipments or, worse, account warnings.

How to manage this efficiently:

- Forecast Demand: Use historical data to predict peaks.

- Plan for Q4: Black Friday and Cyber Monday can make or break your year. Knowing when and how much inventory to send in for Q4 is vital.

- Use a 3PL: A dedicated prep center ensures your goods meet Amazon's strict requirements before they hit the warehouse.

Visual: A graphic novel style illustration of an organized warehouse "superhero" defeating the "Chaos Monster" of disorganized inventory.

Pillar 4: Account Health & Seller Support Escalation 🛡️

Nothing strikes fear into the heart of an Amazon seller like a performance notification. Whether it’s a "Product Authenticity" complaint or a sudden listing suppression, the stakes are high.

Most sellers get stuck in a loop of automated "canned" responses from Seller Support. A core benefit of hiring an amazon agency is their expertise in amazon seller support escalation.

The Escalation Strategy

When a standard ticket doesn't work, we move to a higher level. This involves:

- Providing clear, concise documentation (Invoices, Letters of Authorization).

- Speaking the "language" of Amazon's internal teams.

- Knowing when to push a case to the leadership team.

If you’re currently stuck in a support loop, follow this step-by-step guide on how to escalate a seller support case.

❌ Common Mistake: Sending emotional, angry emails to Seller Support. It doesn't work. Stay professional and data-driven.

Pillar 5: Amazon Brand Management & Protection 🔐

Your brand is your moat. Without proper amazon brand management, you are vulnerable to counterfeiters and "me-too" sellers who can drive your price into the ground.

An agency helps you with:

- Brand Registry: Unlocking powerful tools like the Report a Violation tool and Project Zero.

- Transparency Program: Ensuring every unit shipped is verified as authentic.

- Storefront Design: Creating a branded shopping experience that builds customer loyalty.

Pillar 6: Finding "Free" Money with an Amazon Reimbursement Audit 💰

Amazon makes mistakes. They lose items in the warehouse, damage goods during shipping, and occasionally overcharge on fees. If you aren't looking for these discrepancies, you are leaving money on the table.

An amazon reimbursement audit is a systematic review of your account history to find these errors and file claims on your behalf. Most sellers find that the recovered funds alone can pay for a significant portion of their management fees.

Visual: A comic-style "Treasure Hunter" character finding hidden gold coins (reimbursements) inside a stack of Amazon boxes.

How to Choose the Right Amazon Agency

Not all agencies are created equal. Some are just "tech companies" that plug your account into a software and walk away. Others are true partners.

When evaluating an agency, ask these questions:

- Do they handle logistics? A full-service agency should understand the 3PL warehouse and storage side of the business.

- What is their communication style? You want a partner, not a black box.

- What is their track record? Ask for specific examples of how they’ve handled account health crises.

- What is their pricing? Most professional agencies use a flat monthly fee or a "Base + % of Sales" model. Avoid those who take a massive cut of your gross sales without providing significant value in logistics and strategy.

Summary of Key Takeaways

Scaling on Amazon requires a multi-pronged strategy. If you're ready to move to the next level, keep these points in mind:

- ✅ Optimize Early: Listing optimization is the foundation of all your marketing efforts.

- ✅ Be Aggressive but Smart: Use an amazon advertising agency to manage your spend and prevent wasted budget.

- ✅ Protect Your Account: Don't wait for a suspension to learn about amazon seller support escalation.

- ✅ Recover Your Funds: Regular amazon reimbursement audits ensure you aren't paying for Amazon's mistakes.

- ✅ Focus on Brand: Use amazon brand management tools to build a lasting legacy.

Building a brand on Amazon is a marathon, not a sprint. While you could try to do it all yourself, the most successful sellers know when to call in the professionals. Whether it's handling the day-to-day grind or executing a high-level growth strategy, amazon account management services provide the leverage you need to win.

Ready to see what Marketplace Valet can do for your brand? Let’s get your account performing at its full potential.

#AmazonFBA #EcommerceGrowth #AmazonAgency #PPCManagement #MarketplaceValet