You've hit the $500K revenue mark on Amazon. Congratulations! But here's the thing: scaling past seven figures requires a completely different approach than getting to your first few hundred thousand.

The question keeping you up at night: Should you build an in-house team or partner with an amazon agency?

Let's cut through the noise and break down the real numbers. We're talking full transparency: salaries, overhead, hidden costs, and the ROI you can actually expect from each option in 2026.

The True Cost of Building an In-House Amazon Team

Building your own team sounds appealing. Total control, dedicated resources, and employees who eat, sleep, and breathe your brand. But here's what you're really signing up for:

Essential Team Member Salaries (2026 Market Rates)

Amazon PPC Manager: $65,000 – $95,000/year

- Manages amazon ads management and campaign optimization

- Requires 1-2 years minimum experience with Sponsored Products, Brands, and Display

- Factor in another $15K-$25K for benefits

Listing Optimization Specialist: $55,000 – $75,000/year

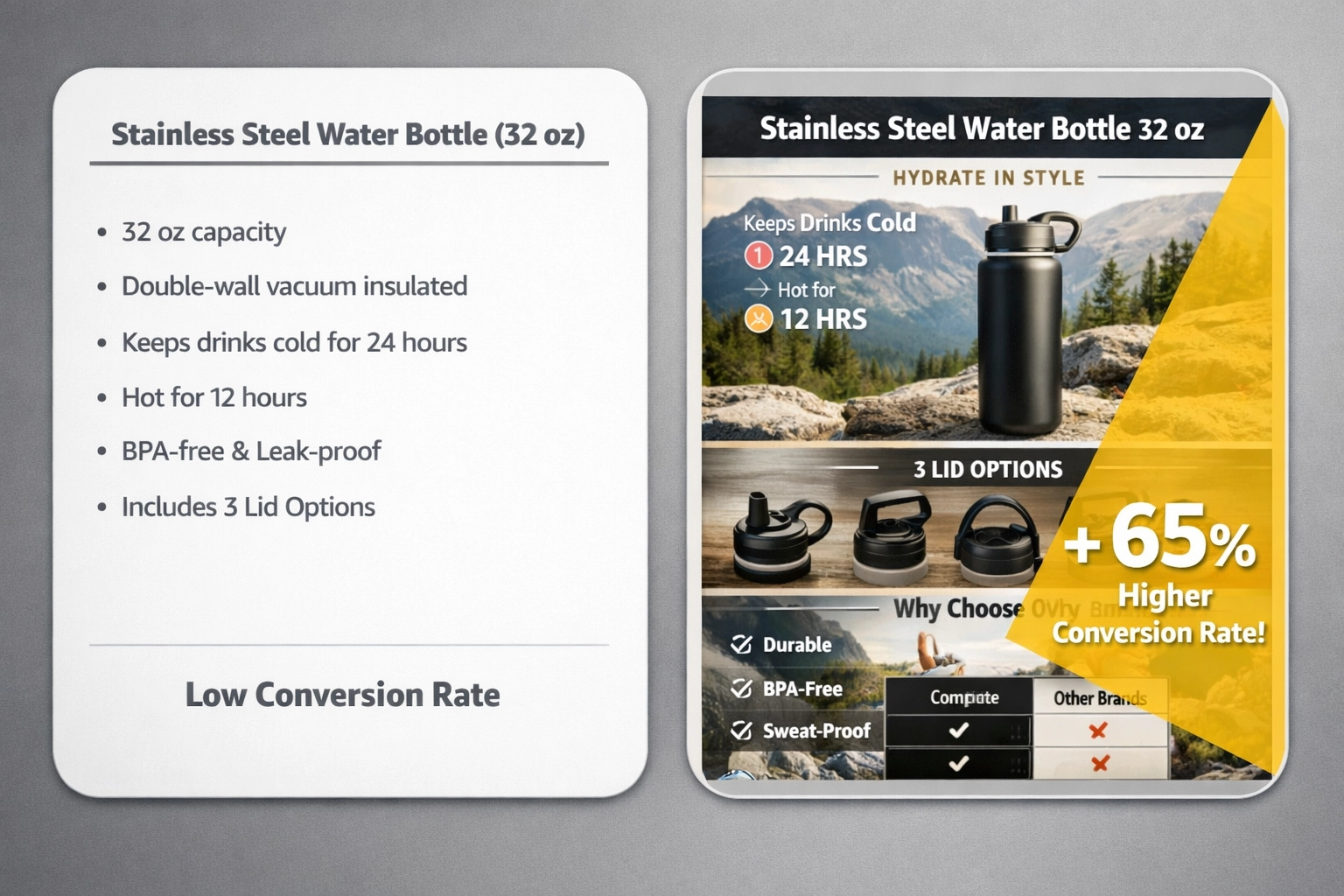

- Handles amazon listing optimization, A+ Content, and brand registry

- Needs copywriting skills and understanding of Amazon's A9 algorithm

- Benefits add $12K-$18K annually

Account Manager/Operations Lead: $70,000 – $100,000/year

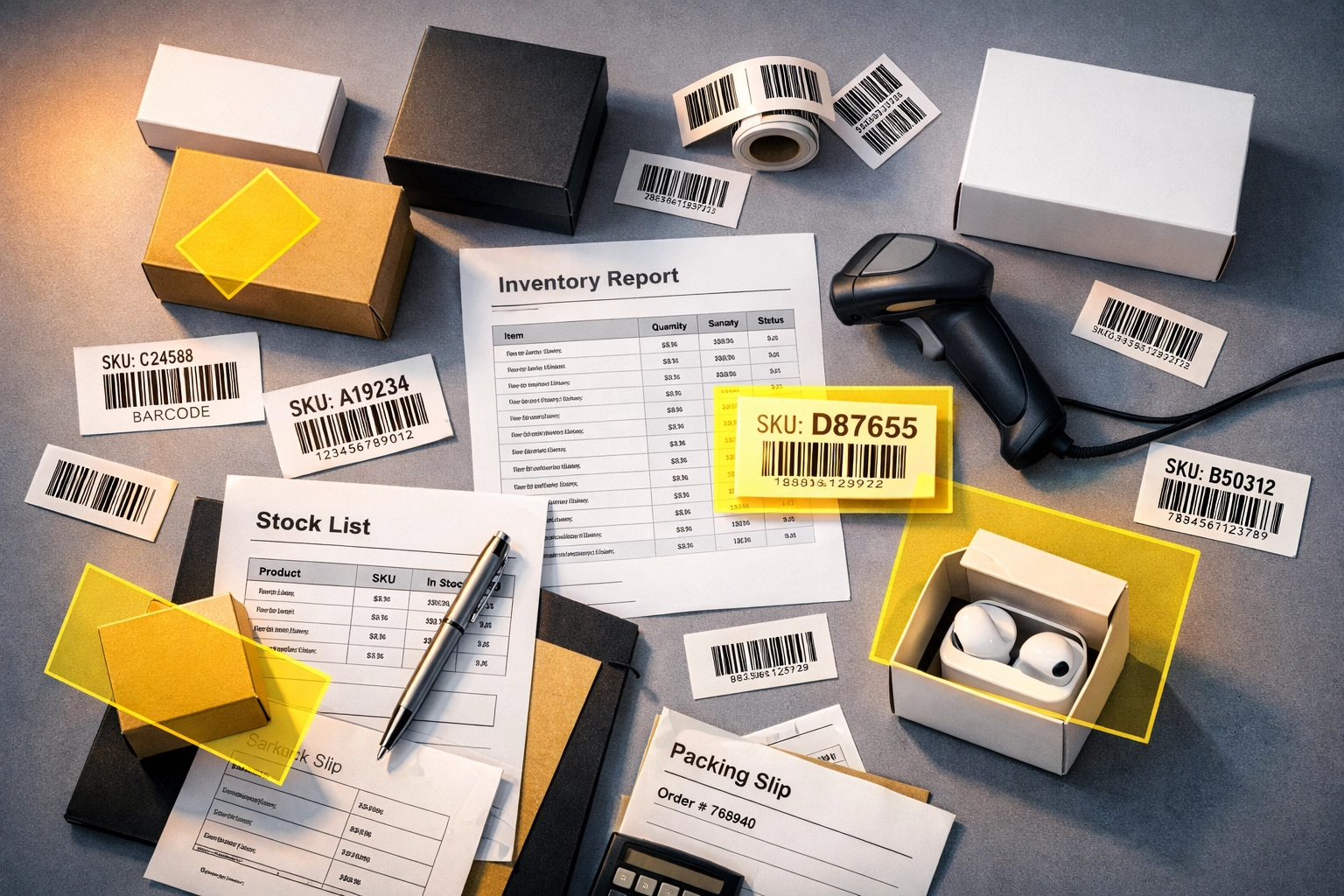

- Oversees amazon account management services including inventory planning

- Manages case escalations and seller support issues

- Benefits package: $18K-$25K

Brand Manager: $75,000 – $110,000/year

- Drives amazon brand management strategy and positioning

- Coordinates product launches and seasonal campaigns

- Benefits: $20K-$28K

The Hidden Costs Nobody Talks About

Software and Tools: $2,000 – $5,000/month

- Helium 10, Jungle Scout, or similar research tools

- PPC automation platforms

- Inventory management software

- Reimbursement tracking tools (or you'll miss thousands in Amazon errors)

Recruitment and Training: $15,000 – $30,000 first year

- Average cost per hire: $4,000 – $7,000

- Training time before they're productive: 3-4 months

- Mistakes during learning curve: immeasurable

Office Infrastructure: $1,500 – $3,000/month

- Workspace costs (even with remote work, you need collaboration tools)

- Equipment and software licenses

- HR and payroll processing

Turnover Risk: 25-35% annually

- E-commerce talent is in high demand

- Replacing an employee costs 50-200% of their annual salary

- Knowledge gaps during transitions can crater performance

Total In-House Investment Year 1: $350,000 – $550,000

What an Amazon Agency Actually Costs in 2026

Here's where things get interesting. Amazon advertising agencies have evolved significantly, and their pricing models reflect the value they bring to the table.

Standard Agency Pricing Models

Percentage of Ad Spend: 10-20%

- Most common for amazon ads management

- If you spend $50K/month on ads, expect $5K-$10K in management fees

- Includes campaign setup, optimization, and reporting

Flat Monthly Retainer: $5,000 – $25,000/month

- Depends on scope: full amazon account management services or specific channels

- Usually includes PPC, listing optimization, and strategic planning

- Higher-tier services include amazon brand management and competitive analysis

Hybrid Models: Retainer + Performance Bonuses

- Base fee of $3,000-$8,000 + percentage of revenue growth

- Aligns agency success with your success

- Common for brands doing $1M+ annually

What's Actually Included?

A solid amazon agency in 2026 should provide:

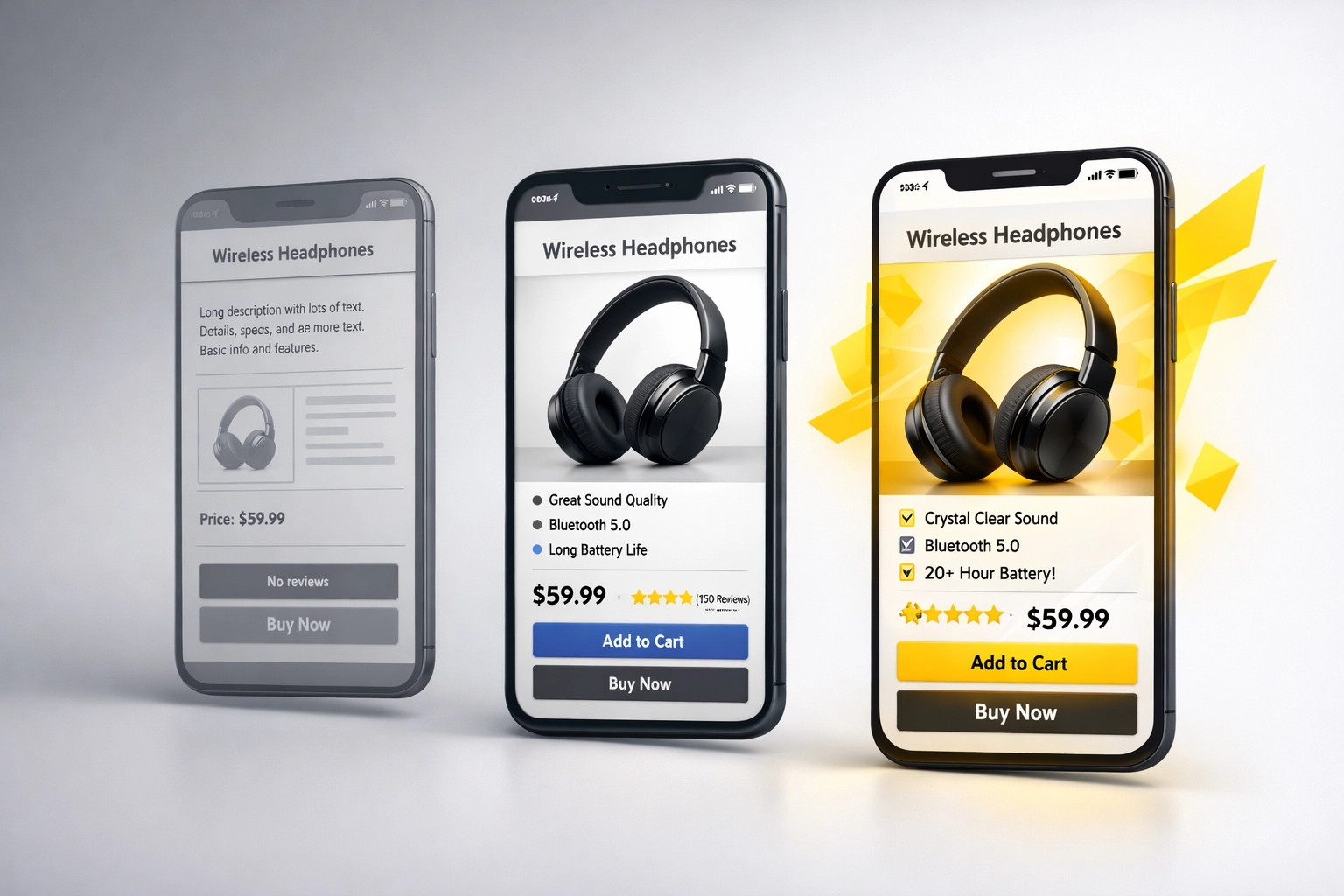

- Complete amazon listing optimization (title, bullets, backend keywords, A+ Content)

- Full amazon ads management across all campaign types

- Amazon seller support escalation when things go wrong

- Monthly amazon reimbursement audit (you're owed more than you think)

- Strategic planning and competitive intelligence

- Dedicated account manager and team

Total Agency Investment Year 1: $60,000 – $300,000 (depending on your revenue scale)

The Real ROI Comparison: Beyond the Sticker Price

Let's compare two $2M/year sellers scaling to $5M:

In-House Team Path

Initial Investment: $400,000 first year

Time to Full Productivity: 6-9 months

Revenue Impact: Incremental growth based on team learning curve

Flexibility: Low (locked into salaries regardless of performance)

Scalability: Requires hiring more people at each growth stage

Agency Partnership Path

Initial Investment: $120,000 – $180,000 first year

Time to Full Productivity: 30-60 days

Revenue Impact: Immediate access to proven strategies and tools

Flexibility: High (scale services up or down monthly)

Scalability: Agency infrastructure grows with you

Here's what most sellers miss: An experienced agency has already made the expensive mistakes. They've tested thousands of campaigns, optimized hundreds of listings, and fought countless Seller Support battles. You're essentially buying years of experience for the cost of one mid-level employee.

The Hidden Value of Agency Relationships

Beyond the spreadsheet, consider these factors:

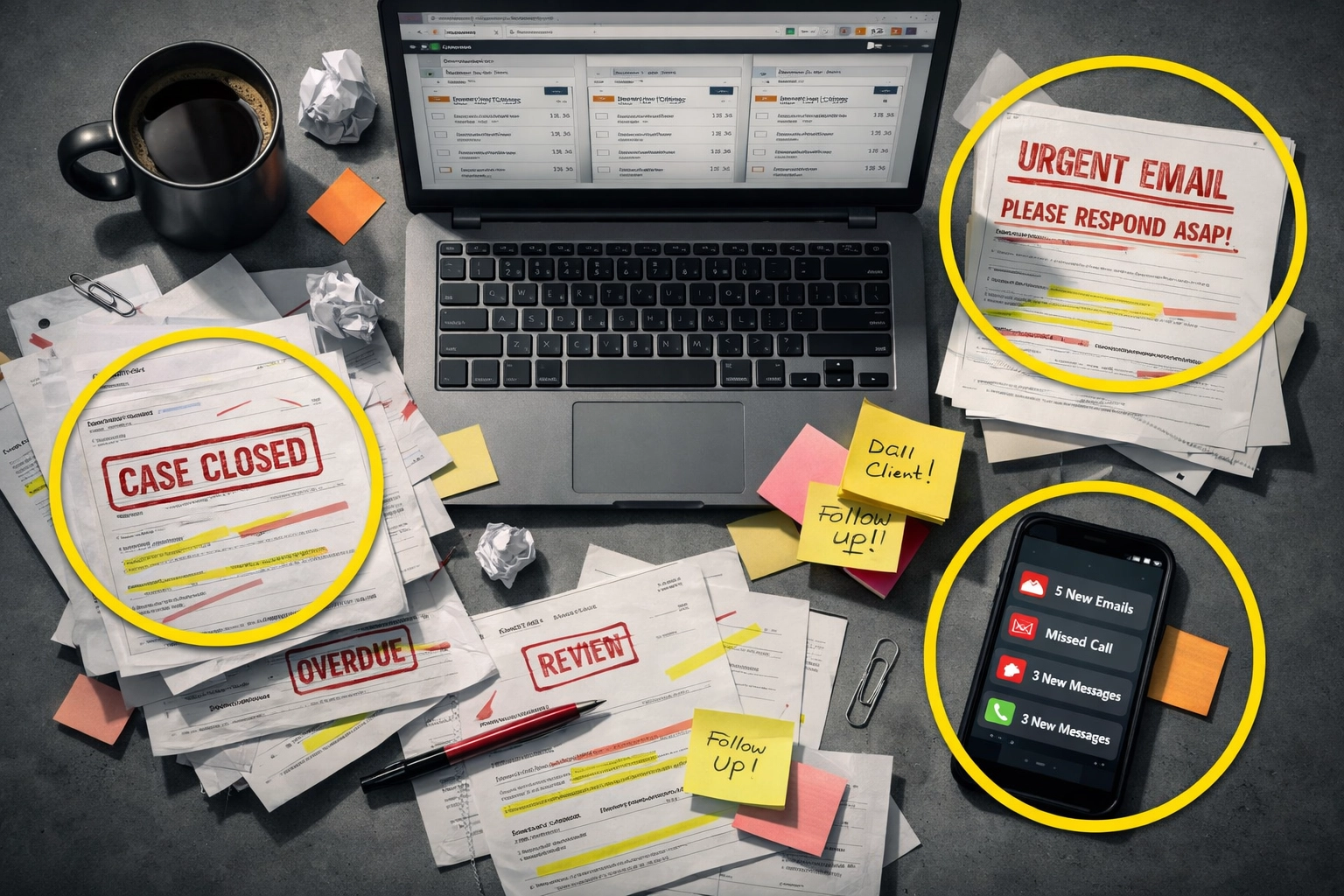

Network Effects: Top agencies have Amazon rep relationships that get you faster resolution on critical issues. When your listing gets suspended at 2am before Prime Day, that connection is priceless.

Tool Access: Premium agencies provide $5,000+/month in software tools as part of their service. That Seller Central case that's been ignored for weeks? A good agency knows exactly which escalation path to use.

Cross-Brand Learning: Your agency manages dozens of brands. Every winning strategy, every algorithm change, every new opportunity: you benefit from their entire client portfolio's learnings.

Risk Mitigation: When Amazon changes policies overnight (like they did with FBA prep services), agencies have contingency plans ready.

When In-House Makes Sense

Building your own team isn't always the wrong move. Consider in-house when:

- You're doing $10M+ annually and can support specialized roles

- Your product requires deep, daily operational involvement

- You're building proprietary systems or processes

- You have the infrastructure to recruit and retain top talent

- You're willing to invest 12-18 months in team development

When an Agency Is the Smart Play

Partner with an amazon advertising agency if:

- You're scaling from $500K to $5M (the danger zone where mistakes are expensive)

- Your current team is stretched thin and making reactive decisions

- You need immediate results without the hiring timeline

- You want to test advanced strategies without risking internal resources

- You'd rather invest capital in inventory than headcount

Many of our most successful clients actually use a hybrid approach: lean internal team for brand vision and day-to-day ops, plus agency partnership for specialized execution and scale.

The Bottom Line: What $400K Really Buys You

That $400K in-house investment gets you:

- 4 employees learning on your dime

- 6-9 months to productivity

- Single-brand experience

- Fixed costs regardless of performance

That same budget with an agency partnership gets you:

- Entire team of specialists (PPC, SEO, design, strategy)

- 30-60 days to impact

- Multi-brand expertise and proven playbooks

- Flexible scaling based on results

- Advanced tools and Amazon relationships included

The math isn't even close.

Making Your Decision

Ask yourself these three questions:

-

Do I have 6-9 months to wait for results? If you need to scale now, agencies win.

-

Can I afford to lose $50K-$100K while my team learns? First-year mistakes with in-house teams are expensive. Agencies have already paid that tuition.

-

Is my core competency building e-commerce teams? If you're a brand builder, product creator, or entrepreneur: let specialists handle Amazon's complexity.

The brands crushing it on Amazon in 2026 aren't debating in-house vs. agency. They're strategically deploying both where each makes sense, or they're going all-in with amazon account management services that let them focus on what they do best: building incredible products.

Ready to see what's possible when you have a dedicated team without the overhead? Let's talk about where your brand is now and where you want to be. Contact Marketplace Valet to get a custom breakdown of what scaling your specific brand would look like: no generic proposals, just real numbers based on your actual data.

And if you're making common scaling mistakes that are costing you thousands monthly, check out our guide on 7 Mistakes You're Making Without an Amazon Agency.